Enrolment – DQ7-10

Enrolment – DQ7-10

This page has information about Delivery at Levels 7 (degree) to 10 on the New Zealand Qualifications and Credentials Framework (DQ7-10) Fund learner admission and enrolment, verification of learner identity and eligibility, payment and refund of fees, confirmed learner enrolments, and learner withdrawals.

This page has information about Delivery at Levels 7 (degree) to 10 on the New Zealand Qualifications and Credentials Framework (DQ7-10) Fund learner admission and enrolment, verification of learner identity and eligibility, payment and refund of fees, confirmed learner enrolments, and learner withdrawals.

On this page:

- Enrolment requirements

- Course withdrawal, programme withdrawal and fees refunds

- Learner-centred provision

- Fees refunds

- Recognition of prior achievement/prior learning

- Tuition fees

Enrolment requirements

Enrolment restrictions

Institutions may restrict the number of eligible learners who can enrol in a programme in accordance with Section 255(4) of the Education and Training Act 2020.

We recommend that you determine and publish:

- the maximum number of learners who can enrol in a particular programme leading to the award of a qualification or course each year, and

- your criteria and processes for selecting learners for the restricted entry programmes or courses.

You may:

- set minimum entry standards for qualifications or courses

- require a learner to achieve satisfactory academic progress

- require a learner to complete another qualification first, and/or

- set admission limits (for example, capped numbers of high cost DQ7-10 provision such as dentistry and aviation).

You must not, however, restrict enrolment in a programme for which DQ7-10 funding is provided based on private advantage (for example, restricting enrolment to the tertiary education organisation’s employees only).

Enrolment form

An enrolment form should collect all of the information that a tertiary education organisation (TEO) is required to report in the Single Data Return (SDR).

To identify all the information that you are required to collect, see the Data Specifications for the Single Data Return.

You may also use the generic enrolment form at Single Data Return.

We recommend that you publish your enrolment form.

Privacy statement

Once you have assessed a learner as eligible, you must provide them with a privacy statement explaining that you are holding their personal information for specified purposes and that you may have disclosure obligations.

For guidance about the information you must provide in your privacy statement, see the base funding conditions in the Funding Conditions Catalogue for the relevant year.

You may wish to use the TEC template privacy statement.

Enrolment application

To enrol in a programme leading to the award of a qualification, the learner needs to apply to the TEO by:

- completing and submitting your enrolment form, and

- providing evidence to enable you to:

- verify the learner’s identity, and

- determine the learner’s eligibility – see DQ7-10 funding conditions for the relevant year.

Enrolment process

We recommend that your admission and enrolment process for DQ7-10 includes the steps below:

| Step | Responsibility | Action |

|---|---|---|

| 1 | TEO | Provides information on qualification programmes of study (including courses), the admission and enrolment process, and the withdrawal and fees refund process (including any impacts on learner eligibility for fees-free tertiary education in the future) |

| 2 | Learner | Applies to the TEO for admission and enrolment (separately or together) |

| 3 | TEO | Verifies the learner’s identity |

| 4 | TEO | Confirms the learner’s eligibility to study (and eligibility for provision funded through DQ7-10) |

| 5 | TEO | Recognises prior learning |

| 6 | TEO | Makes a formal offer to enrol the learner on a course or programme, excluding recognised prior learning |

| 7 | Learner | Formally accepts the offer |

| 8 | TEO | Records the enrolment |

| 9 | TEO | Invoices the learner for any tuition fees and charges, including any student services fees (SSFs) adjusted post-recognised prior learning |

| 10 | Learner | Pays any tuition fees and charges, or arranges for them to be paid |

| 11 | TEO | Records payment of any tuition fees and charges, and applies the relevant Student Fee Protection arrangements, as applicable. |

| 12 | TEO | Provides the learner with information about all planned learning activities in their programme |

| 13 | TEO | Provides refunds for learners who withdraw from courses within the defined withdrawal period for fees refund, and records these refunds |

| 14 | TEO | Records the learner as a confirmed learner enrolment once the fees refund period has passed |

| 15 | TEO | Records the learner as a valid domestic enrolment once the 10% or one month (whichever is earlier) period for eligibility for TEC funding has passed |

Note: We expect you to inform each learner during the enrolment process about all planned learning activities leading to the award of the qualification the learner has enrolled in. “Planned learning activities” includes self-learning activities you expect the learner to engage with/participate in. It does not include self-directed activities the learner initiates.

Also note that there are additional enrolment requirements under the New Zealand Qualifications Authority (NZQA) rules and the Tertiary and International Learners Code of Practice.

Education (Pastoral Care of Tertiary and International Learners) Code of Practice 2021 – NZQA

Admission

We expect you to publish admission information before the start of each programme.

This information should include:

- admission requirements

- tuition fees and other course costs

- criteria and process for selecting learners for entry into restricted entry courses (if relevant)

- criteria and process for assessing and recognising a learner’s prior learning

- criteria and process for cross-crediting courses across multiple qualifications

- documents that a learner must submit (for example, a learner’s academic transcript or record from another TEO)

- the enrolment process

- minimum attendance and code of conduct requirements

- withdrawal requirements and process, including refunds

- learner support services available, and

- student services fees (SSFs) information in accordance with the relevant funding conditions on SSFs.

For requirements for tertiary education institutions (TEIs) and registered private training establishments (PTEs) to provide information about fees, see the funding conditions for the relevant year and the relevant data specifications.

Also note that there are additional requirements under the NZQA Rules and Tertiary and International Learners Code of Practice.

Enrolment changes

If a learner’s enrolment changes for any reason, you must update your records to reflect the changes. We recommend you send updated enrolment information to the learner.

Confirmed learner enrolment

All DQ7-10 funded TEOs must report all confirmed learner enrolments with a programme start date on or after 1 January in the SDR. For the definition of a confirmed learner enrolment, see the funding conditions for the relevant year.

Confirmed learner enrolments apply to programme, course and micro-credential enrolments where fees apply, including student service fees (SSFs). It ensures that we gain a wider understanding of TEO enrolments by including enrolments where the TEO receives fees from a learner and does not refund the fees after a withdrawal.

You must ensure that your SDR accurately records all “confirmed learner enrolments” where fees apply. A confirmed learner enrolment occurs where:

- a learner and your organisation have entered an enrolment or tuition contract, training agreement, or other arrangement and the learner (or their employer) has paid or committed to pay their fees; and

- the period during which the learner is entitled to withdraw from a programme or micro-credential, and/or component part, and the learner or employer receive a full refund of fees (less any applicable administration fee) has passed; and

- the learner has not received a full refund of fees (less any applicable administration fee).

Course withdrawal, programme withdrawal and fees refunds

Withdrawals

A “withdrawal” is when a learner ceases to participate in a course, programme or micro-credential (regardless of whether they have been refunded any fees), either:

- by providing notice to the TEO that they wish to withdraw from participation, study and/or enrolment, or

- as a result of non-attendance or non-participation for any reason.

Disengaged learners who have not formally withdrawn

A learner may have disengaged from the programme or micro-credential but not have formally withdrawn. For example, they may not have attended a face-to-face course or not logged in for online learning.

Determine at the earliest opportunity if a disengaged learner is withdrawing from a course. If the enrolment continues to be reported and is unsuccessful, it will be counted as a course non-completion for the calculation of Educational Performance Indicators (EPIs).

Setting a withdrawal date for a withdrawn learner

TEOs need to apply a “withdrawal date” to any enrolment in the Single Data Return (SDR).

For the requirements for withdrawal dates for TEIs and registered PTEs, including reporting withdrawals to StudyLink and other parties, see the funding conditions for the relevant year.

You will not be able to receive funding for an enrolment with a withdrawal date that occurs before 10% or one month of the course has passed (rounded up to the nearest whole day), whichever is earlier.

Learner-centred provision

Learners wanting to defer their start date

You may agree to defer a learner’s enrolment start date, but you should have a policy for the circumstances under which a learner may do this.

Note: No DQ7-10 funding can be claimed unless the learner has started their study and the 10% or one-month date for accessing funding has passed. For more details see DQ7-10 funding conditions for the relevant year.

Learners wanting to accelerate their study (undertake additional learning)

You should not enrol a learner in an additional course or qualification unless the learner elects to exceed the annual equivalent full-time student (EFTS) value of the qualification to accelerate their programme of study or training.

For example, a learner may choose to complete a three-year qualification in two-and-a-half years by undertaking a higher than usual course load each year.

In that instance we expect the additional learning hours to be matched by an appropriate number of additional teaching hours.

Example: A qualification that is 34 weeks each year in length is generally 1.0 EFTS in value each year, which equates to 0.03 EFTS each week.

0.03 EFTS per week x 34 weeks = 1.0 EFTS.

If a learner studies for 52 weeks in a year, the maximum amount of EFTS that we will fund for the learner is 1.56 EFTS.

0.03 EFTS per week x 52 weeks = 1.56 EFTS.

You must ensure that such a learner understands the workload that will be required to achieve their course and qualification completions.

Inducement

An enrolment is not a valid domestic enrolment if the learner has been induced to enrol. For details see the funding conditions for the relevant year.

We recommend that you contact us to discuss this before offering items or activities to learners for enrolling with you.

Learner fees refund period

You need to apply a fee refund period. If a learner withdraws from a course or programme within this period, they must receive a refund of fees (or waiver of fee payment) and course costs (minus any administration fees).

The refund period requirements are different for registered private training establishments (PTEs) and tertiary education institutions (TEIs).

For more information on learner fees refunds, see the funding conditions for the relevant year.

Course withdrawal, programme withdrawal and fees refunds

Course withdrawal, programme withdrawal and fees refund practice can determine whether an enrolment must be reported as a confirmed learner enrolment under Source of Funding code 31 (SoF 31). Importantly, these practices can differ for registered private training establishments (PTEs) and tertiary education institutions (TEIs).

The course enrolment must be reported under SoF 31, regardless of whether:

- a course enrolment passes the 10%- or one-month threshold for claiming TEC funding, or

- the TEO does not claim funding for the course enrolment, or

- the TEO retains some or all fees for the course enrolment.

For example, in Example 1 (below) this would mean that courses 1 and 2 would be reported under SoF 31 if fees are retained but no TEC funding is claimed.

Withdrawing by programme and retaining fees

For some TEOs, mainly registered PTEs, when a learner withdraws from study the TEO may withdraw them from the whole programme (or qualification) and retain all the fees for that programme. This is done even though the start date may not have been reached for all course enrolments making up the programme.

TEOs that withdraw learners by programme and retain fees for courses that the TEO does not claim TEC funding for must report these courses confirmed learner enrolments under SoF 31.

Withdrawing by course and retaining fees

For other TEOs, when a learner withdraws from study the TEO withdraws the learner from courses within the programme that the learner did not start or participate in for 10% or one month (whichever is earlier). The TEO retains fees only for the courses where the enrolment became a valid course enrolment reported under SoF 01.

TEOs that withdraw learners by course and refund their fees in full do not have to report those enrolments as, at the point of fees refund or waiver, they cease to be confirmed learner enrolments.

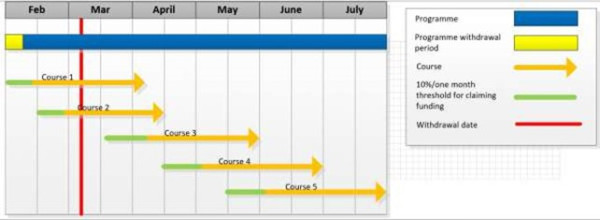

Example 1: Refunding tuition fees when withdrawing learners by course or by programme

The tuition fees to be refunded to the learner will differ depending on whether the TEO withdraws learners by course or by programme.

- If the TEO withdraws learners by course, the learner will receive a refund of the tuition fees for courses 3, 4 and 5. This is because the fees refund period for courses 3, 4 and 5 has not passed.

- If the TEO withdraws learners by programme, no refund of tuition fees is required as the fees refund period for the programme has passed.

- If no refund (excluding any administration charges) is given to the learner:

- enrolments for courses 1 and 2 will need to be reported under SoF 31 if no TEC funding is claimed (if funding is claimed, courses 1 and 2 must be reported under SoF 01.)

- enrolments for courses 3, 4 and 5 must be reported under SoF 31.

- Alternatively, if the TEO fully refunds the learner for courses 3, 4 and 5 (less any administration charges), these courses do not need to be reported.

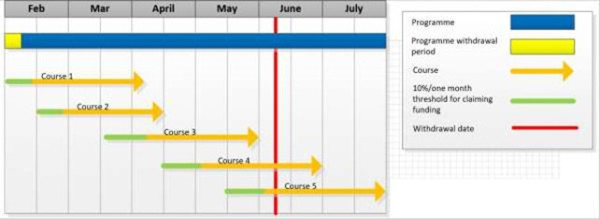

Example 2: Refunding tuition fees with June withdrawal date and staggered course start dates

The TEO is not required to refund fees regardless of whether learners are withdrawn by course or by programme. This is because the fees refund period has passed for both the programme and courses. These courses would not need to be reported under SoF 31 and would instead be reported under the relevant SoF for a valid domestic enrolment, as per the current practice.

However, if the TEO retains fees and does not claim TEC funding, they must report the course enrolments under SoF 31.

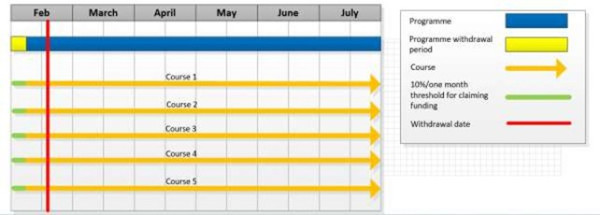

Example 3: Refunding tuition fees with same course start and end dates

The example above shows an enrolment where there are five courses that all have the same start and end date. In this instance the fees refund period is the same for all of the courses as well as the programme.

As the withdrawal date has been reached for both the programme and the course, the TEO is not required to refund the learner any fees regardless of whether the TEO withdraws learners by course or programme.

For courses where the learner participated for at least 10%-or-one-month (whichever is earlier), report the enrolment under SoF 01.

However, if the TEO retains fees and does not claim TEC funding, the TEO must report the course enrolments under SoF 31.

Reporting of withdrawals

We require TEOs to report enrolments where the TEO retains some or all the learner’s fee(s) if the learner withdrew after the fees refund period, if:

- the learner withdrew after the fees refund period, but before the enrolment became eligible for TEC funding, and

- the learner withdrew after the fees refund period, and after the enrolment became eligible for TEC funding, but the TEO is not claiming funding.

This requirement does not apply to:

- first-year fees free enrolments (course, micro-credential and/or programme) or

- enrolments where the learner has:

- not paid the fees by the due date/date committed to, and/or

- received a full refund of fees (course, micro-credential and/or programme) less any applicable administration fee.

The confirmed learner enrolments must be reported in the SDR under SoF 31 (if the learner had not withdrawn, the enrolments would be reported under SoF 01 for DQ7-10).

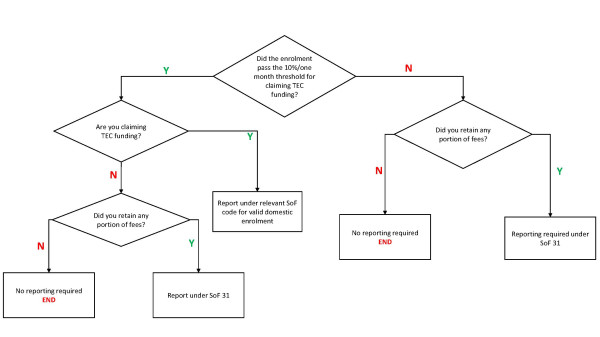

Example 4: How to report DQ7-10 course enrolments

Scholarships

If you decide to pay for the learner’s fees through a scholarship, after the learner has already paid fees, the learner remains a confirmed learner enrolment.

Educational Performance Indicators (EPIs)

Confirmed learner enrolment data (SoF 31) is included in EPI calculations.

Advising StudyLink and other parties of learner withdrawal

When a learner in receipt of a loan and/or allowance withdraws from study, the date of withdrawal that you must notify to StudyLink is the date you determined that the learner had ceased to participate (eg, for non-attendance or non-participation).

Example

First date of non-attendance:

- 7 March 2025

Date the TEO determined that the learner had stopped participating:

- 12 March 2025

Withdrawal date the TEO advises to StudyLink, and reports in the SDR:

- 12 March 2025

Date by when the TEO must have advised StudyLink of the withdrawal:

- 19 March 2025

Fees refunds

Fees refund when the enrolment changes

You must make clear to the learner at enrolment the period during which they may change their enrolment(s) or withdraw from a course or programme with a fees refund (less any administration charge).

You must process fees refunds in a timely manner for the learner.

If you refund all or some of a learner’s fees, you must refund the learner in the way the original fee was paid. This could be to StudyLink, if the learner paid using the Student Loan Scheme, or directly to the learner.

Where the learner is entitled to a refund, you cannot hold the refund as a credit (for example, for the learner enrolling/re-enrolling at your organisation in the future) unless you can demonstrate that the learner has understood their refund entitlement and agreed to waive their entitlement.

Full fees refund

If you decide to refund all of a learner’s fees after the fees refund period has passed (eg, on compassionate grounds) they cease to be a confirmed learner enrolment and should not be reported in the SDR.

Part fees refund

If you decide to refund some of a learner’s fees after the fees refund period has passed (eg, on compassionate grounds) they remain a confirmed learner enrolment for the purposes of reporting to us and must be included in the SDR.

No fees refund

A learner who has withdrawn from their course (formally or informally) or been expelled after the fees refund period has passed, and who has not received a fees refund, remains a confirmed learner enrolment for the purposes of reporting to us and must be included in the SDR.

These requirements also apply when you decide to pay for the learner’s fees through a scholarship.

Learners with unpaid fees

A learner is only a confirmed learner enrolment when they have paid or committed to pay fees and the fees refund period has passed.

If the learner does not pay the fees as they committed, they then cease to be a confirmed learner enrolment or a valid domestic enrolment. You must not claim DQ7-10 funding for them.

Recognition of learner prior achievement/prior learning

Recognition of prior learning/prior achievement refers to previous study or experience (prior achievement) relevant to the programme the learner is about to enrol in or is currently studying. It enables a learner to proceed with their study without repeating aspects of the qualification previously studied, or re-learning skills they have already achieved through past work or other experience.

Recognition of prior learning (RPL) and credit recognition and transfer (CRT) are forms of recognising prior learning/prior achievement. For more information, see:

Guidelines for the recognition and award of learning for credit – NZQA

It is the TEO’s responsibility to recognise each learner’s prior learning and adjust the courses in their programme.

If the learner has achieved course content previously, you must:

- work out the EFTS factor of their prior learning (relative to the standard course)

- subtract this from the standard course EFTS factor

- submit the revised EFTS factor in the enrolment file of the SDR, in the FACTOR field, for that learner.

You cannot claim DQ7-10 funding or learner fees for RPL or CRT, or for delivering tuition where the learner already has prior learning (ie, skills and/or knowledge).

This means you are responsible for:

- undertaking a preliminary evaluation of the learner and identifying whether they are likely to have the knowledge, skills and attributes that can contribute to the graduate outcomes of the qualification.

- seeking evidence of prior academic achievement, including using an NZQA Record of Achievement, when each learner enrols.

More information on RPL or CRT is available at Recognition of learning for credit – NZQA.

If you have any questions, please contact NZQA.

Tuition fees

Tuition fees invoicing

We expect you to provide the learner with an invoice that specifies the courses in which they have been accepted, and itemises the fees and course costs for each course the learner is enrolled in.

The learner then pays the fees specified in the invoice or arranges for them to be paid.

Tuition fees receipt

After you have received payment (or confirmation that payment has been arranged), we expect you to issue a receipt to the learner.